rsu tax rate us

Deferred Tax Asset 30 300. Go to IRSgovOrderForms to order current forms instructions and publications.

Transitioning From Stock Options To Rsus Pearl Meyer

An ESPP or Employee Stock Purchase Plan is an employer perk that allows employees to purchase a companys stock at a discount.

. An employee stock option ESO is a stock option granted to specified employees of a company. Capital gains tax is imposed on profit - the increase in value as a result of appreciation. You can send us comments through IRSgovFormComments.

These cookies will be stored in your. In the case of RSUs taxes are based on vesting. Annual Revenue Retention Rate.

Temporary Difference Tax Base Carrying Amount. The Rivers State University RSU Port Harcourt was established in October 1980 from the Rivers State College of Science and Technology which was itself established in 1972. Each outstanding equity-based award to the extent then vested will be canceled and converted into the right to receive an amount in cash without interest equal to the product obtained by multiplying 1 the amount of the Merger Consideration by 2 the total number of shares of Twitters common stock then subject to the then-vested portion of such equity-based.

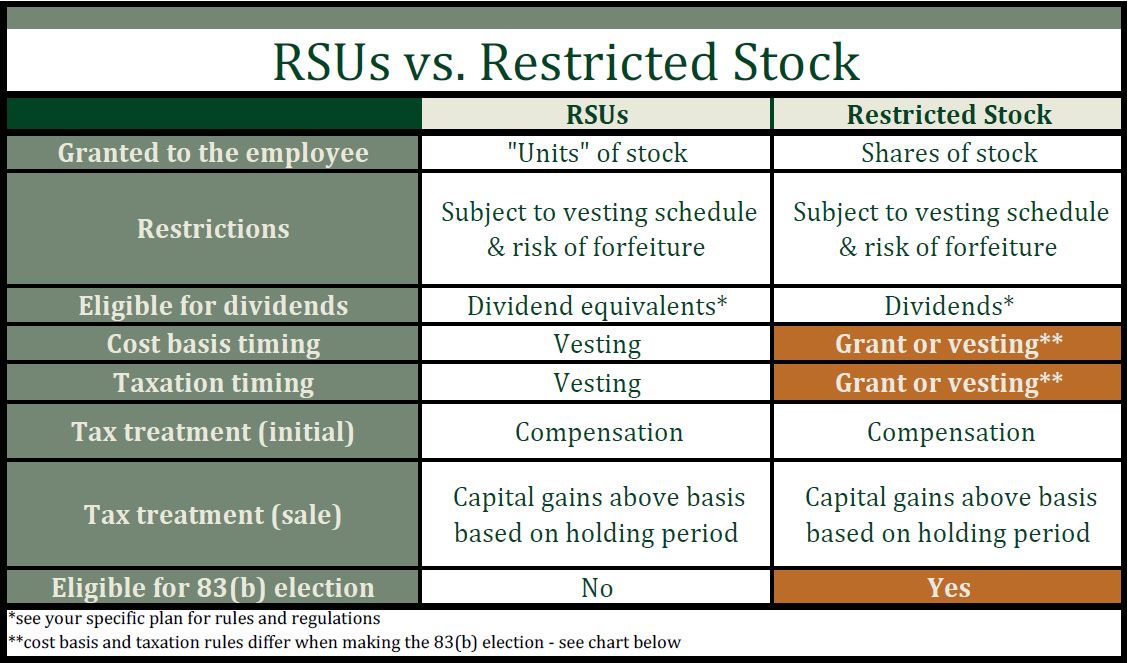

Here we discuss top difference between stock options and RSU restricted stock units with infographics comparative table. RSUs are taxed at ordinary income rates when issued typically after vesting. The aggregate market value of the voting and non-voting stock held by non-affiliates of the Registrant as of March 26 2021 the last business day of the Registrants most recently completed second fiscal quarter was approximately 2021360000000Solely for purposes of this disclosure shares of common stock held by executive officers and directors.

The discount rate is used in the concept of the Time value of money- determining the present value of the future cash flows in the discounted cash flow analysisIt is more interesting for the investors perspective. Deferred Tax Asset Tax Rate Temporary Difference. Ordering tax forms instructions and publications.

Upon vesting the amount is considered as ordinary income. Call 800-829-3676 to order prior-year forms and instructions. Americas 1 tax preparation provider.

The most significant implication for employees is a 25000 benefit. You receive 4000 RSUs that vest at a rate of. Ordering tax forms instructions and publications.

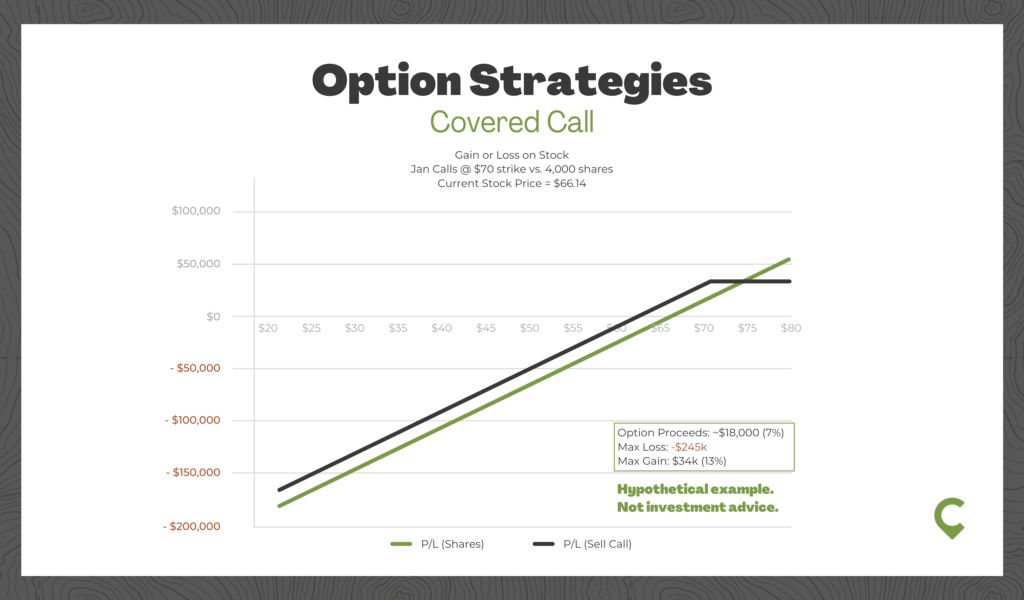

The following hypothetical example outlines the entire life cycle of an RSU grant. David Kindness is a Certified Public Accountant CPA and an expert in the fields of financial accounting corporate and individual tax planning and preparation and investing and retirement planning. The following tax sections relate to US tax payers and.

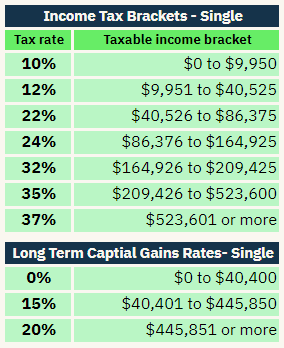

The IRS will process your order as soon as possible. In order to pay the tax Alice chooses to sell half of the stock immediately but does not immediately sell 12500 worth of stock. View stock market news stock market data and trading information.

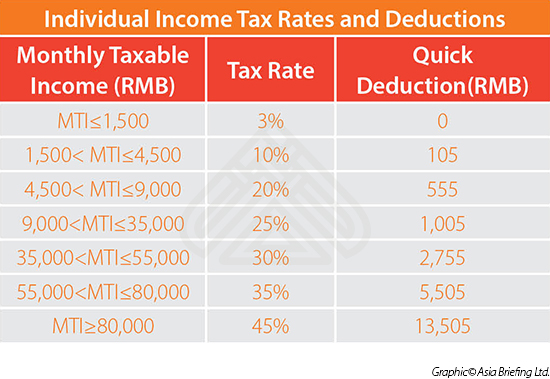

Employee Stock Option - ESO. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. The income tax must be withheld at the flat rate applicable to the qualified stock options or qualified RSU gains 18 30 or 41 for gains realised in 2020 or at the specific progressive withholding tax rates applicable to compensation income if the beneficiary has elected to have the gain taxed at the progressive rates of income tax.

Alice now has a tax liability on the 25000 worth of stock which is taxed at the ordinary income rate. Monday - Tueday - 830 am to 400 pm. Alice has 25000 worth of RSU stock vest in 2019 meaning Alice now owns the stock outright.

If you hold on to your RSU stock and the stock gives you dividends then youll have to pay ordinary income taxes on those dividends. US a Customer of both Pushpay and Church Community Builder. RSU tax at vesting date is.

For non-qualifying disposition taxes are paid at the time of sale at the income tax rate. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. An average beginning day balance of 150000 or more in any combination of this account and linked qualifying deposits¹ investments² OR a linked Chase Platinum Business Checking SM account.

Ordinary Income Tax. Deferred Tax Asset 90. We also use third-party cookies that help us analyze and understand how you use this website.

The rate at which your stock vestsreferred to as the vesting scheduleis described in your grant agreement. RSUs do show up on form W-2. If at the time of settlement the company grants stocks and the employee.

It is located at Nkpolu-Oroworukwo in Port Harcourt the capital of Rivers State Nigeria. Temporary Difference 1800 1500. NW IR-6526 Washington DC 20224.

Chris previously served as the CEO of Church Community Builder. Deferred Tax Asset is calculated using the formula given below. The Rail Infrastructure Sector Understanding RSU See Annex V of the Arrangement was implemented in January 2014.

If you sell it after the stock price has increased then you will owe capital gains tax. 5 gain x 2000 shares x 15 tax rate. Qualified ESPPs known as Qualified Section 423 Plans to match the tax code have to follow IRS rules to receive favored treatment.

ESOs offer the options holder the right to buy a certain amount of. It is important for you to contact your tax advisor about the impact of these events on your taxes. 1 online tax filing solution for self-employed.

RUT A complete Russell 2000 Index index overview by MarketWatch. Capital gains tax is imposed only if the stockholder holds on to the shares and they appreciate in value before being sold. Does RSU show up on W2.

Chris also played a key role in the formation of Outreach Inc httpswww. Suppose the tax rate is 30. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

In Finance the discount rate can be defined as the following. Follow Us Facebook Twitter Town Offices 630 Hallowell Road Durham Maine 04222 207 353-2561 Hours. Go to IRSgovOrderForms to order current forms instructions and publications.

Example Of RSU Life Cycle. Oklahoma news and the latest from NPR. The time value of money means a fixed amount of money has different values at a different point in.

There is a 35 Monthly Service Fee for Chase Private Client Checking OR 0 when you have at least one of the following each statement period. Then she could use the first 9500 of the proceeds to max out her 401k accountnetting a tax reduction of 2280 9500 x 24. Self-Employed defined as a return with a Schedule CC-EZ tax form.

Using the ESPP Tax and Return Calculator. Dont resubmit requests youve already sent. This annex provides more flexible terms and conditions for the provision of officially supported export credits relating to new railway infrastructure projects to meet the variable needs of public authorities and exporters and to promote the use of rail as a.

¹ Qualifying personal deposits include. Restricted Stock Unit RSU A companys commitment to give a specific number of shares of stock or cash equivalent to an employee at a future date once vested.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

The Great Benefits Of Restricted Stock And Restricted Stock Units Rsus Mystockoptions Com

Common Rsu Misconceptions Brooklyn Fi

Rsu Taxes Explained 4 Tax Strategies For 2022

.png?width=2108&name=Add%20a%20subheading%20(9).png)

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Restricted Stock Unit Rsu Tax Strategies To Save On Tax Bill In 2022 Trica Equity Blog

Granting Restricted Stock Units To Your Employees In China China Briefing News

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Common Rsu Misconceptions Brooklyn Fi

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Stock Based Compensation Back To Basics

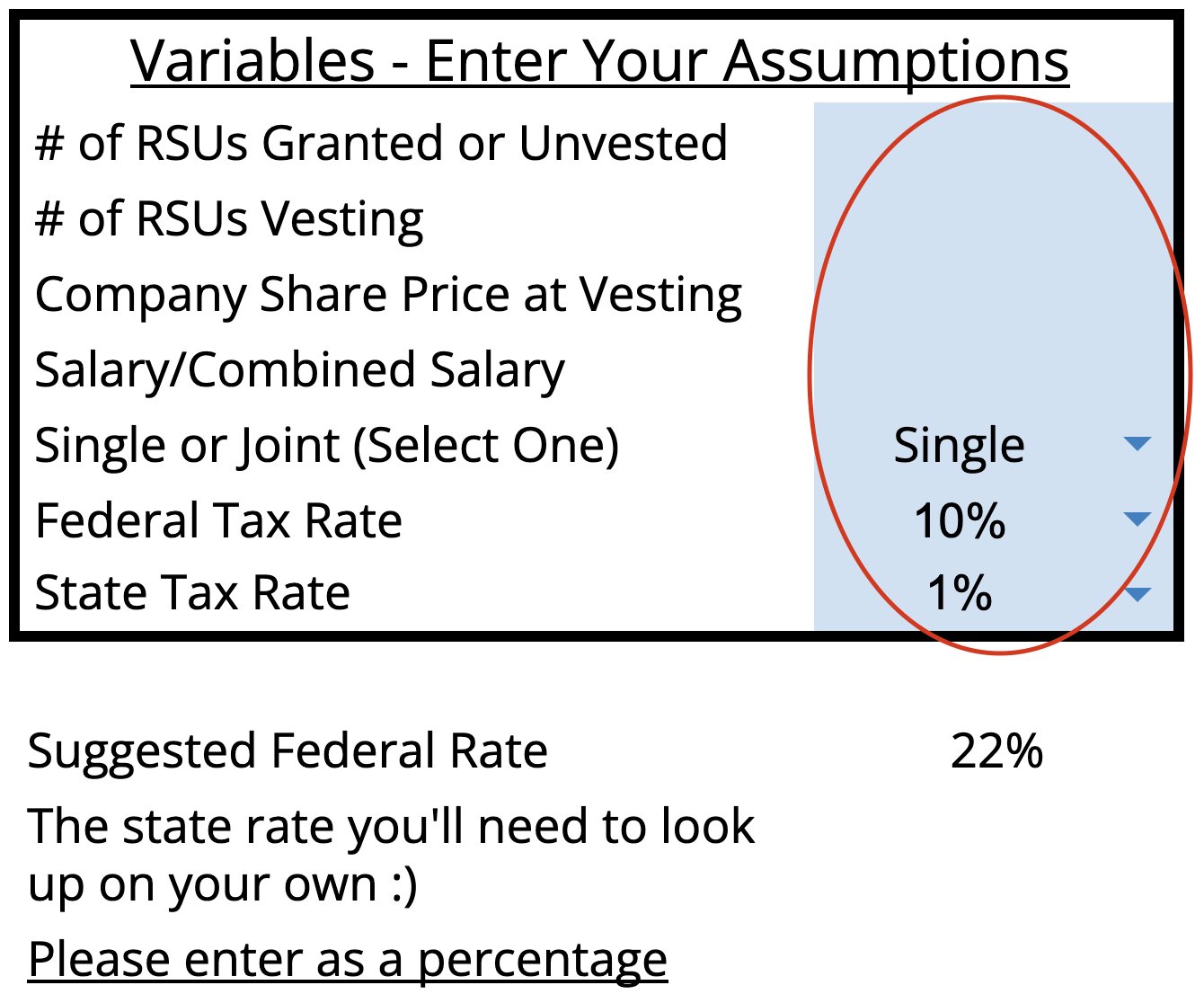

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

My Company Gave Me Rsus Now What

Rsus A Tech Employee S Guide To Restricted Stock Units

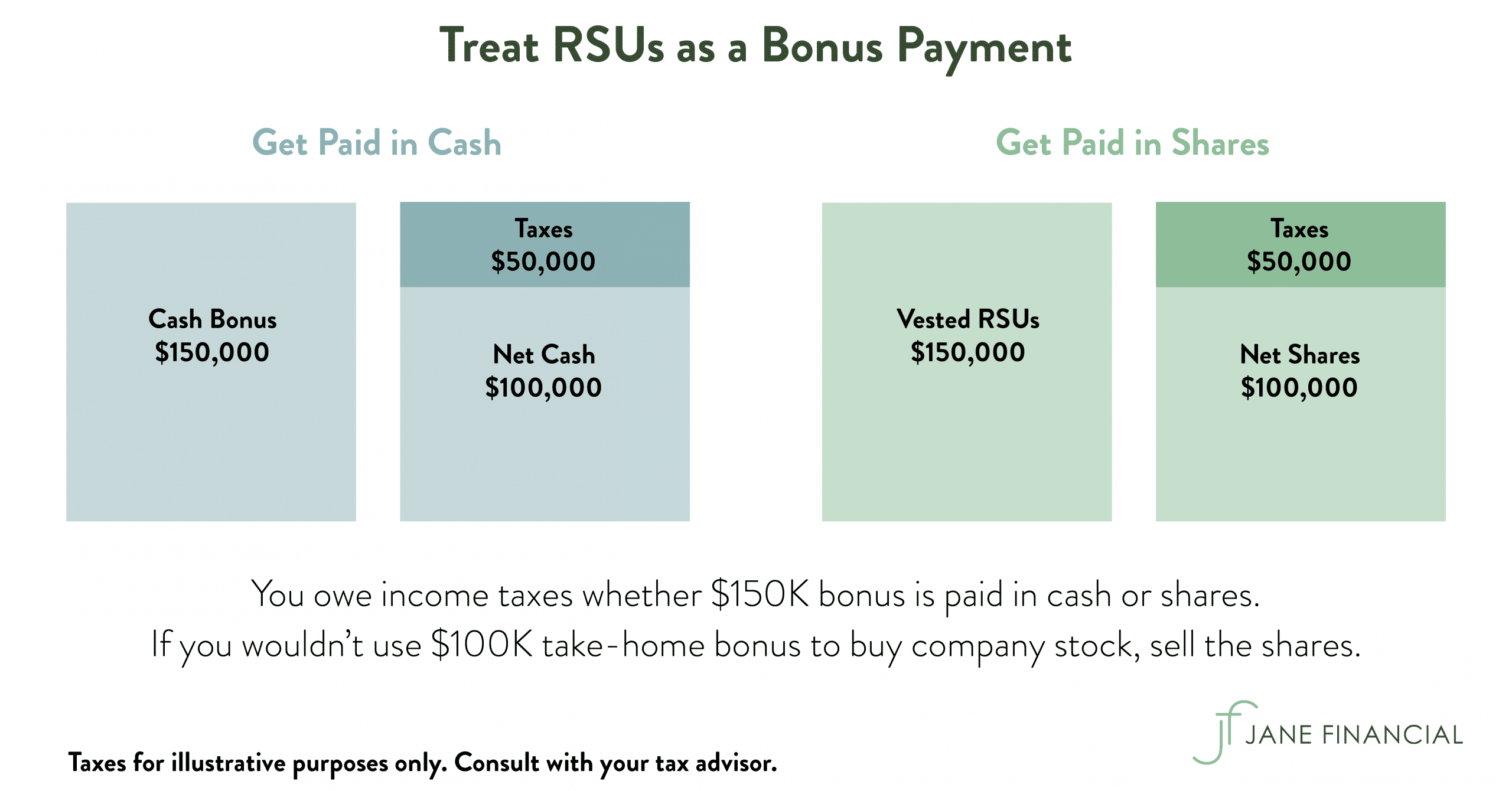

Restricted Stock Units Jane Financial

Restricted Stock Unit Taxes Your W 2 Everything Else You Should Know Tl Dr Accounting

Don T Pay Tax Twice On Rsu Sales Parkworth Wealth Management